Introduction

Gold has been a cornerstone of wealth and stability for centuries, and one of the most common forms in which gold is traded today is bullion bars. These bars are a popular choice for both seasoned investors and newcomers to the precious metals market. This article provides an in-depth look at gold bullion bars, their significance, and tips on how to invest in them effectively.

What Are Bullion Bars?

Bullion bars are precious metals, such as gold, silver, platinum, or palladium, that have been refined to a high standard of purity and cast into bars of various sizes. Gold bullion bars are particularly sought after for their value and liquidity. They come in different weights, typically ranging from 1 gram to 1 kilogram or more, with the most common weights being 1 ounce, 10 ounces, and 1 kilogram.

Why Invest in Bullion Bars?

Stability and Security

Gold bullion bars are considered a safe haven asset. They tend to retain their value even during economic downturns, providing a hedge against inflation and currency fluctuations.

Tangible Asset

Unlike stocks or bonds, bullion bars are a physical asset. Investors can hold them, store them, and sell them when needed. This tangibility adds a layer of security that digital or paper assets cannot provide.

Portfolio Diversification

Including bullion bars in an investment portfolio can diversify and reduce overall risk. Gold often moves inversely to other asset classes, making it an effective counterbalance during market volatility.

Types of Gold Bullion Bars

Gold bullion bars come in two main types: cast bars and minted bars.

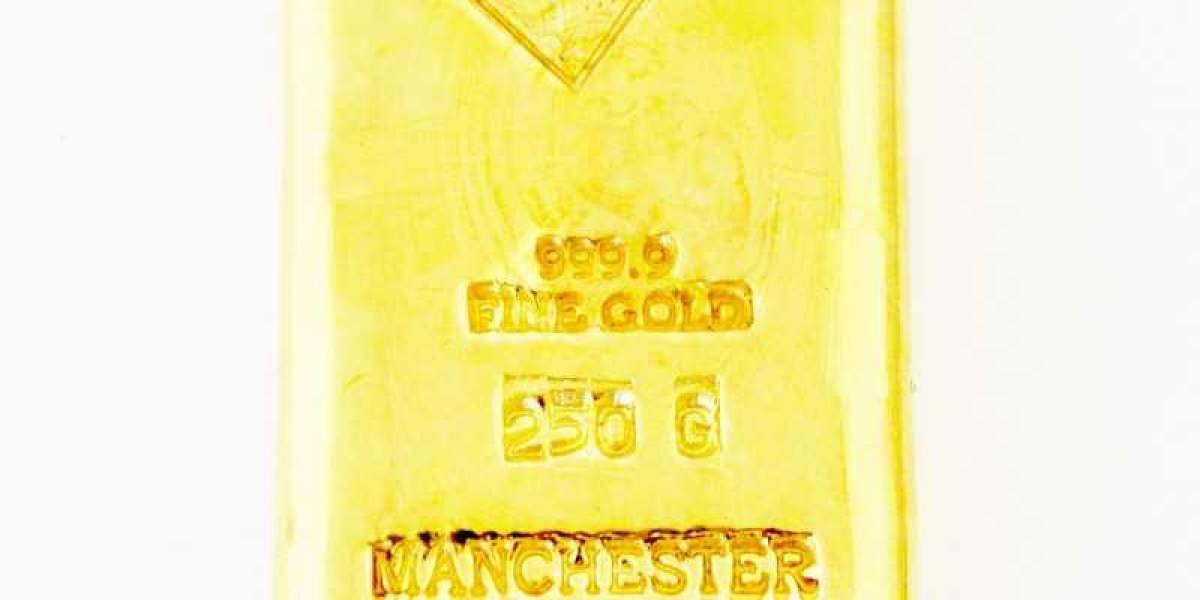

Cast Bars

Cast bars, also known as ingots, are created by pouring molten gold into molds. This process gives them a rougher appearance and a more industrial look. They are generally less expensive to produce than minted bars.

Minted Bars

Minted bars are cut from a larger sheet of gold and then stamped with specific designs and inscriptions. These bars have a more polished and refined appearance, often featuring intricate designs, hallmarks, and serial bullion bars numbers. They tend to be more expensive due to the additional craftsmanship involved.

How to Buy Gold Bullion Bars

When purchasing gold bullion bars, consider the following factors:

- Purity: Ensure the bars have a high level of purity, typically 99.5% or higher. This information is usually stamped on the bar.

- Weight: Choose a weight that fits your investment goals and budget. Remember that larger bars often have lower premiums per ounce but may be less liquid.

- Reputable Dealers: Buy from reputable dealers who offer certified products. Look for those who provide a certificate of authenticity and have a proven track record.

- Storage: Decide where you will store your gold. Options include home safes, bank safety deposit boxes, or professional bullion storage facilities.

Storing Gold Bullion Bars

Proper storage is crucial to maintaining the value and condition of your bullion bars. Here are some storage options:

- Home Storage: If you choose to store gold at home, invest in a high-quality safe and consider additional security measures.

- Bank Safety Deposit Boxes: These offer a secure and relatively inexpensive storage solution.

- Professional Storage: Many dealers offer storage services in highly secure facilities. These services often include insurance and regular audits.

Selling Gold Bullion Bars

When it’s time to sell your gold bullion bars, consider the following:

- Market Conditions: Keep an eye on gold prices and market trends to sell at the best possible time.

- Reputable Buyers: Sell to reputable buyers or dealers who offer fair market value. Avoid pawn shops or less-established buyers who may offer lower prices.

Conclusion

Gold bullion bars are a solid investment for those looking to secure their wealth and diversify their portfolios. Their stability, tangible nature, and historical value make them a preferred choice among investors. By understanding the types of bullion bars, knowing how to buy and store them, and being aware of the best selling practices, you can make informed decisions and maximize your investment in this timeless asset.