Evaluating Your Item for a Pawnshop Loan

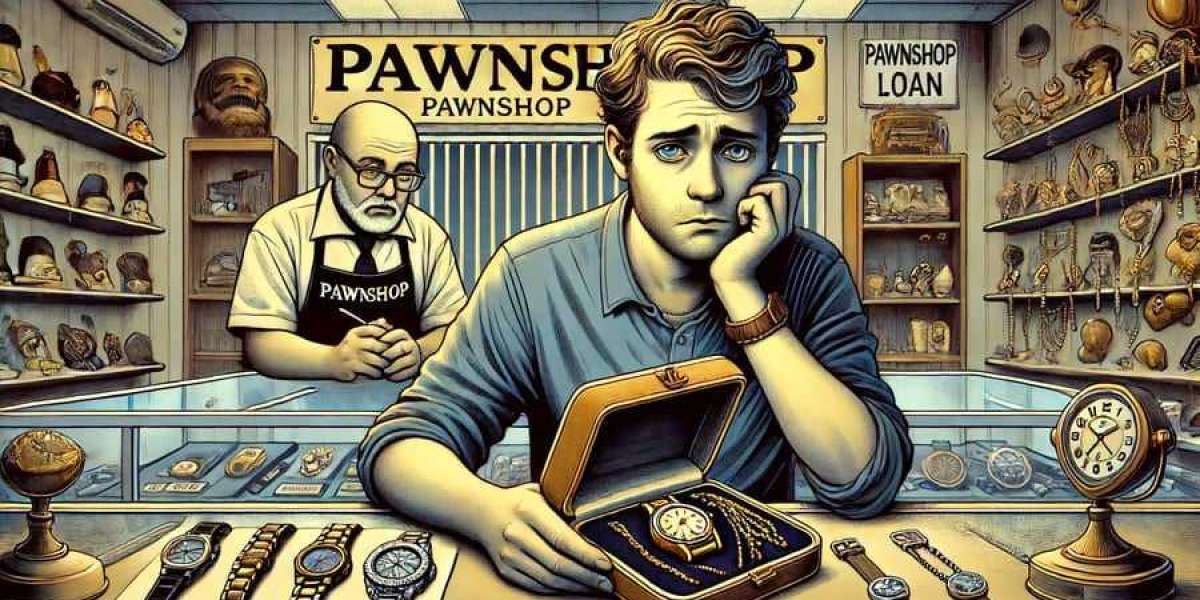

Before approaching a pawnshop, understanding tips on how to evaluate your item is essential. Start by researching comparable objects on-line to gauge their market worth. Consider the situation of your merchandise; if it shows indicators of damage and tear, it could affect the worth that the pawnbroker provides. Documentation, such as receipts or certificates of authenticity, also can play a task in enhancing your item's pr

Many organizations give consideration to providing academic assets and workshops aimed at enhancing financial literacy amongst women. With a better understanding of economic phrases and ideas, ladies can approach lenders confidently and negotiate phrases which may be most favorable to t

Advantages of Low-Credit Loans

One of the primary benefits of low-credit loans is accessibility. Even with poor credit, borrowers can acquire necessary funds quickly. This can be particularly beneficial in emergencies the place timing is of the essence. Furthermore, making timely repayments on a low-credit mortgage can positively influence one’s credit rating over time, permitting people to rebuild their creditworthiness. Low-credit loans may also provide an opportunity for financial schooling, as many lenders present sources to help borrowers understand budgeting and debt managem

Disadvantages of Low-Credit Loans

Despite their advantages, low-credit loans include significant disadvantages. The most notable concern is the high-interest charges that accompany these loans, which might make them troublesome to repay. Additionally, many low-credit loans have short reimbursement periods, which may result in a cycle of debt if debtors are unable to pay them off shortly. Furthermore, some lenders might have interaction in predatory practices, similar to automated withdrawals from a borrower's checking account, which might create additional monetary str

Microloans are notably significant as they usually supply smaller amounts at low-interest charges. They are accessible to girls who might lack collateral or a strong credit history, making them a superb possibility for new entreprene

Yes, refinancing a no-document mortgage is feasible but could rely upon the terms of the unique loan and the borrower’s financial situation on the time of refinancing. It’s advisable to verify with lenders concerning their refinancing choices and necessit

The reimbursement course of for pawnshop loans entails returning to the pawnshop within a specific period, usually ranging from 30 days to a number of months. You will want to pay again the mortgage amount plus any accrued curiosity and charges. Once fully paid, you will obtain your pawned merchandise back. Failure to repay will outcome in the pawnshop maintaining the merchand

Characteristics of Low-Credit Loans

Low-credit loans tend to have a quantity of defining traits. First, they're usually supplied by different lenders, payday mortgage corporations, or credit score unions rather than traditional banks. Second, the applying course of is usually streamlined, permitting for faster entry to funds. However, debtors should be cautious, as these loans may come with unfavorable terms, such as high-interest charges and hidden fees. Additionally, the amount one can borrow is often restricted, reflecting the chance associated with lending to these with poor credit histor

Cautions on No-Visit Loans

Despite the many advantages, debtors should be cautious when using No-Visit Loans. The ease of online applications can typically lead individuals to tackle extra debt than they'll manage. This situation can lead to a cycle of debt, significantly with high-interest payday lo

The Role of BePick in Loan Research

BePick serves as a useful useful resource for individuals looking for complete info on low-credit loans. The platform offers detailed reviews and comparisons of various lenders, permitting customers to make informed choices. By offering insights into the pros and cons of different mortgage options, BePick helps customers navigate the complexities of buying a low-credit mortgage. Additionally, the location includes practical ideas and guides on improving credit scores and managing debt successfully, making it an all-encompassing information for those in need of financial assista

Importantly, these loans not only serve as monetary assistance but in addition aim to spice up the arrogance of women in managing finances and business operations. This empowerment can lead to higher success charges for female enterprise owners, which in flip advantages the econ

The process of obtaining a pawnshop mortgage is relatively easy. First, you assess your priceless merchandise and visit a neighborhood pawnshop. The pawnbroker evaluates your item and presents you with a mortgage offer primarily based on its estimated worth. If you settle for the offer, you hand over the merchandise, and the money is given to you immediately. Remember, you will need Monthly Payment Loan to pay back the loan inside a specified timeframe to reclaim your i

pbhjoel5260252

1 Blog posts