Gold bars have long been a reliable store of value, and the 100g 999.9 gold bar, which is a 24-karat (99.99% pure) bar, is one of the most popular choices for investors. The price of a 100g gold bar fluctuates daily based on the gold spot price and various other factors. For investors interested in acquiring this mid-sized gold bar, understanding the price dynamics, purchase considerations, and potential benefits is essential. This article explores everything you need to know about the price of a 100g 999.9 gold bar, including factors that influence its cost and how to make an informed purchase.

Overview of the 100g 999.9 Gold Bar

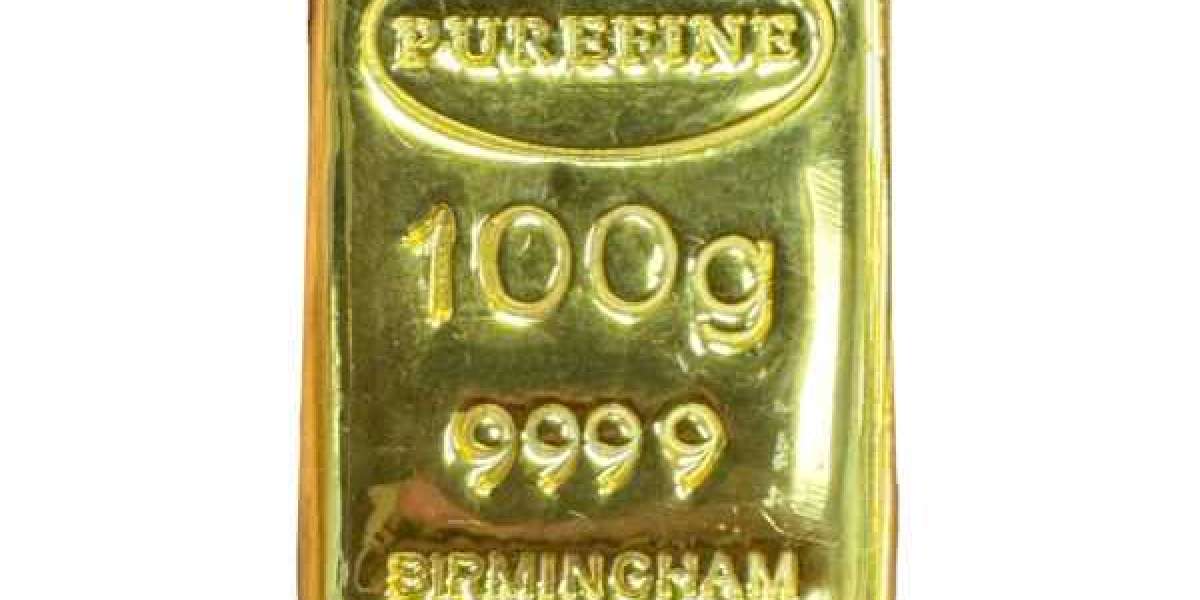

A 100g gold bar with a purity of 999.9 (or 99.99%) is typically rectangular, stamped with the weight, purity, and brand of the refinery. Renowned mints like PAMP Suisse, Valcambi, and the Royal Canadian Mint produce high-quality 100g bars that come with a certificate of authenticity and serial numbers. This weight class is popular because it provides a significant amount of gold at a manageable cost, allowing investors to acquire substantial value without committing to larger, bulkier bars like the 1kg gold bar.

Specifications of a 100g 999.9 Gold Bar:

- Weight: 100 grams

- Purity: 99.99% fine gold

- Dimensions: Approximately 49mm x 28mm x 3mm (dimensions vary slightly by refiner)

- Certification: Typically comes with an assay card or certificate of authenticity, and a unique serial number for tracking

Factors That Affect the Price of a 100g 999.9 Gold Bar

The price of a 100g gold bar is influenced by several factors, including the spot price of gold, dealer premiums, and overall market demand. Understanding these factors can help you make better decisions about when and where to buy.

Gold Spot Price

- The spot price of gold is the market price for one ounce of gold, which fluctuates based on supply, demand, and economic factors. Since the value of a 100g gold bar depends on this price, any increase or decrease in the spot price directly impacts the cost of the bar. The spot price is quoted in real-time and reflects the international gold market, often influenced by inflation rates, geopolitical tensions, and global economic stability.

Dealer Premiums

- In addition to the spot price, gold bars include a premium charged by dealers,100g 999.9 gold price which covers production, refining, shipping, and distribution costs. Premiums can vary based on factors like the brand, quality, and purity of the bar, as well as the dealer’s pricing policies. For 100g bars, premiums tend to be lower than for smaller gold bars, making them a more cost-effective option per gram.

Brand and Refinery Reputation

- Bars from reputable refiners like PAMP Suisse, Valcambi, and Heraeus are in higher demand and often come with a higher premium. These brands guarantee a certain level of quality and come with tamper-proof packaging and assay certificates, which help retain resale value.

Economic Conditions

- Economic instability often leads to higher gold demand, as investors turn to safe-haven assets. During times of economic uncertainty, inflationary periods, or currency devaluation, the demand for gold bars typically rises, driving up both the spot price and premiums. Conversely, during times of economic stability, the price of gold may stabilize or even decrease slightly.

Global Supply and Demand

- Gold is mined globally, and shifts in supply—whether due to mining production or geopolitical issues—can influence the overall availability of gold, impacting prices. Likewise, demand for gold jewelry, technology, and investment can shift the price of gold bars over time.

How to Buy a 100g 999.9 Gold Bar at the Best Price

Monitor Spot Price Movements

- Regularly check the current spot price of gold, as it fluctuates due to global economic factors. Knowing when prices dip can help you find a more affordable buying opportunity.

Compare Dealer Premiums

- The price of a 100g gold bar can vary across dealers, primarily due to different premium levels. Comparing prices from various dealers, whether online or in-store, can help you identify the best deal. Reputable dealers like APMEX, JM Bullion, and Kitco often have transparent pricing that allows for straightforward comparisons.

Consider Buying in Bulk or at a Fixed Price

- Some dealers offer discounts for bulk purchases or fixed prices if buying multiple bars. If you’re planning to make a substantial investment, inquire about bulk discounts or consider purchasing multiple 100g bars to maximize cost efficiency.

Choose Reputable Refiners

- Buy bars from respected brands, such as PAMP Suisse, Valcambi, or the Royal Canadian Mint. Although these bars may have slightly higher premiums, they are easier to liquidate and hold value better due to their trusted quality.

Consider Tax Implications

- In some regions, gold purchases are subject to capital gains tax or VAT. Knowing the tax rules in your area can help you plan your investment strategy and avoid unexpected costs upon purchase or sale.

Benefits of Investing in a 100g 999.9 Gold Bar

Flexibility and Value: The 100g size is a midpoint between smaller bars and larger bars like the 1kg bar, offering a balance of value and ease of resale. The bar’s purity and manageable size make it a versatile choice for investors looking to hedge against inflation.

High Purity and Quality: With a 99.99% purity, the 100g gold bar is one of the purest investment-grade bars available, often accompanied by certification and tamper-proof packaging.

Efficient Storage and Portability: 100g bars are compact enough to store securely without taking up significant space. They are also easily transported compared to larger bullion products, making them ideal for investors who value portability and security.

Liquidity: 100g gold bars are widely recognized and accepted globally, making them easy to liquidate. Brands like PAMP Suisse and Valcambi are highly trusted, making resale easier if you choose to sell your bar in the future.

Where to Buy a 100g 999.9 Gold Bar

Online Dealers: Reputable websites like APMEX, JM Bullion, and Kitco offer a wide selection of 100g gold bars. These dealers often provide competitive pricing, secure shipping, and additional documentation like assay certificates, making the purchasing process transparent and reliable.

Local Banks and Bullion Dealers: In some countries, banks and licensed bullion dealers sell 100g gold bars. This option is secure and convenient, especially if you want to buy and store locally.

Directly from Mints: Some government and private mints sell gold 100g 999.9 gold pricebars directly to the public. This can sometimes be more affordable, as it eliminates intermediary costs, and provides peace of mind about the authenticity and purity of the gold.

Auctions and Marketplaces: While not as common, auctions and reputable online marketplaces sometimes sell 100g gold bars. However, exercise caution, as these platforms may have a higher risk of counterfeits. Ensure you verify the seller’s reputation and look for certified gold bars with authentication documentation.

Important Considerations Before Buying a 100g Gold Bar

Storage and Security: Given the bar’s value, it’s essential to have a secure storage solution, such as a personal safe, bank safety deposit box, or a specialized bullion storage facility. Many dealers offer insured storage services for added security.

Insurance: If storing gold at home, consider insuring your gold bar to protect against theft or loss. Insuring your bar can provide peace of mind, especially if you plan to hold it as a long-term investment.

Liquidity and Exit Strategy: Have a clear understanding of your exit strategy. If you ever need to liquidate your investment, a 100g gold bar from a reputable refiner is generally easy to sell, but planning for timing and market conditions can ensure you get the best return on your investment.

Conclusion

A 100g 999.9 gold bar is a versatile, cost-efficient, and highly liquid investment choice. Priced according to the gold spot price and influenced by premiums, it offers a relatively affordable entry point for those looking to invest in physical gold without the storage challenges of larger bars. By purchasing from reputable dealers, staying informed on market trends, and selecting well-recognized brands, you can secure a valuable asset that serves as a hedge against economic uncertainty and a stable store of wealth.